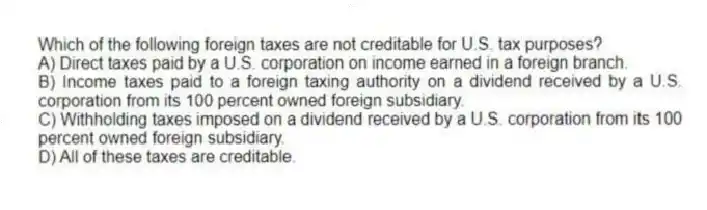

Which of the following foreign taxes are not creditable for U.S. tax purposes?

A) Direct taxes paid by a U.S. corporation on income earned in a foreign branch.

B) Income taxes paid to a foreign taxing authority on a dividend received by a U.S. corporation from its 100 percent owned foreign subsidiary.

C) Withholding taxes imposed on a dividend received by a U.S. corporation from its 100 percent owned foreign subsidiary.

D) All of these taxes are creditable.

Correct Answer:

Verified

Q22: A U.S. corporation can use hybrid entities

Q38: Russell Starling, an Australian citizen and resident,

Q39: Under which of the following scenarios could

Q46: Hanover Corporation, a U.S. corporation, incurred $300,000

Q48: Which of the following foreign taxes is

Q49: Which of the following expenses incurred by

Q54: Under a U.S. treaty, what must a

Q66: Which of the following tax benefits does

Q68: What form is used by a U.S.

Q75: A rectangle with a triangle within it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents