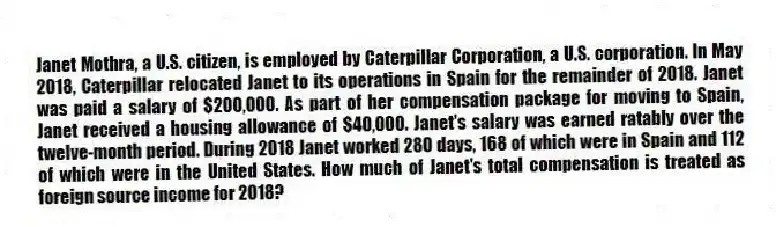

Janet Mothra, a U.S. citizen, is employed by Caterpillar Corporation, a U.S. corporation. In May 2018, Caterpillar relocated Janet to its operations in Spain for the remainder of 2018. Janet was paid a salary of $200,000. As part of her compensation package for moving to Spain, Janet received a housing allowance of $40,000. Janet's salary was earned ratably over the twelve-month period. During 2018 Janet worked 280 days, 168 of which were in Spain and 112 of which were in the United States. How much of Janet's total compensation is treated as foreign source income for 2018?

Correct Answer:

Verified

Janet apportions 60% (168/280) ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: Which of the following transactions engaged in

Q73: Jesse Stone is a citizen and bona

Q74: Obispo, Inc., a U.S. corporation, received the

Q76: Vintner, S.A., a French corporation, received the

Q77: Jimmy Johnson, a U.S. citizen, is employed

Q79: Appleton Corporation, a U.S. corporation, reported total

Q80: Windmill Corporation, a Dutch corporation, is owned

Q81: Rainier Corporation, a U.S. corporation, manufactures and

Q82: Rafael is a citizen of Spain and

Q83: Spartan Corporation, a U.S. company, manufactures widgets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents