Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, Formed

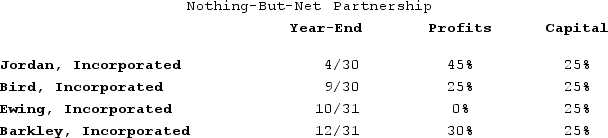

Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, formed Nothing-But-Net Partnership on June 1st, 20X9. Now, Nothing-But-Net must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Nothing-But-Net use, and what rule requires this year-end?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q82: On March 15, 20X9, Troy, Peter, and

Q83: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q85: Which of the following would not be

Q89: Which of the following statements regarding partnership

Q90: Jay has a tax basis of $14,000

Q91: J&J, LLC, was in its third year

Q93: Jay has a tax basis of $20,000

Q97: Which person would generally be treated as

Q98: On March 15, 20X9, Troy, Peter, and

Q99: If a taxpayer sells a passive activity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents