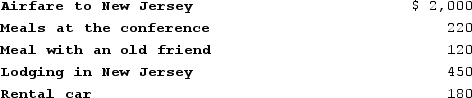

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelley documented her expenditures (described below) . What amount can Shelley deduct?

A) $2,850

B) $2,740

C) $1,850, if Shelley itemizes the deductions

D) All of these expenses are deductiblebut only if Shelley attends a conference in Texas.

E) None of the expenses are deductible because Shelley visited her friend.

Correct Answer:

Verified

Q22: Paris operates a talent agency as a

Q26: Dick pays insurance premiums for his employees.

Q28: Even a cash-method taxpayer must consistently use

Q29: Which of the following is a true

Q30: The 12-month rule allows taxpayers to deduct

Q33: Which of the following expenditures is NOT

Q34: This year Clark leased a car to

Q36: Which of the following business expense deductions

Q38: Holly took a prospective client to dinner,

Q39: In order to deduct a portion of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents