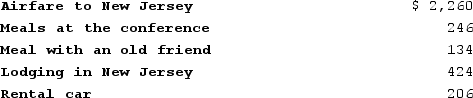

Shelley is self-employed in Texas and recently attended a two-day business conference in New Jersey. After Shelley attended the conference, she had dinner with an old friend who lived nearby. Shelley documented her expenditures (described below) . What amount can Shelley deduct?

A) $3,136

B) $3,013

C) $2,006, if Shelley itemizes the deductions

D) All of these expenses are deductible but only if Shelley attends a conference in Texas.

E) None of the expenses are deductible because Shelley visited her friend.

Correct Answer:

Verified

Q25: Which of the following is likely to

Q28: Even a cash-method taxpayer must consistently use

Q30: The 12-month rule allows taxpayers to deduct

Q36: Which of the following business expense deductions

Q38: Holly took a prospective client to dinner,

Q42: George operates a business that generated revenues

Q49: Don operates a taxi business, and this

Q52: Don operates a taxi business, and this

Q57: Which of the following expenditures is completely

Q60: For purposes of the business interest limitation,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents