Which of the following is a true statement about a request for a change in accounting method?

A) Some requests are automatically granted.

B) Most requests require the permission of the commissioner.

C) Many requests require payment of a fee and a good business purpose for the change.

D) Form 3115 is typically required to be filed with a request for change in accounting method.

E) All of the choices are true.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

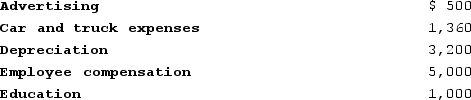

93) Smith operates a roof repair business. This year, Smith's business generated cash receipts of $32,000, and Smith made the following expenditures associated with his business: The education expense was for a two-week, nighttime course in business management. Smith believes the expenditure should qualify as an ordinary and necessary business expense. What net income should Smith report from his business? Smith is on the cash method and calendar year.

The education expense was for a two-week, nighttime course in business management. Smith believes the expenditure should qualify as an ordinary and necessary business expense. What net income should Smith report from his business? Smith is on the cash method and calendar year.

Correct Answer:

Verified

Q88: Manley operates a law practice on the

Q99: Todd operates a business using the cash

Q104: Rock Island Corporation generated taxable income (before

Q105: Otto operates a bakery and is on

Q110: Mike operates a fishing outfitter as an

Q121: Ranger Athletic Equipment uses the accrual method

Q122: Shadow Services uses the accrual method and

Q123: Murphy uses the accrual method and reports

Q125: Taffy Products uses the accrual method and

Q126: Joe operates a plumbing business that uses

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents