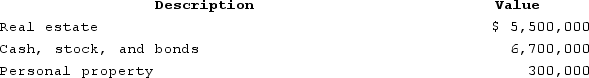

Chloe's gross estate consists of the following property valued at the date of death:  Chloe's real estate is encumbered by a mortgage of $450,000, and Chloe's executor paid her funeral costs of $6,000 and charged fees for $24,000. Which of the following is a true statement?

Chloe's real estate is encumbered by a mortgage of $450,000, and Chloe's executor paid her funeral costs of $6,000 and charged fees for $24,000. Which of the following is a true statement?

A) Chloe's adjusted gross estate is at least $12,020,000.

B) Chloe's taxable estate is at least $12,020,000.

C) Chloe's taxable estate is $12,050,000.

D) Chloe's estate will calculate the tentative estate tax on $12.5 million.

E) None of the choices are true.

Correct Answer:

Verified

Q81: Tracey is unmarried and owns $17 million

Q82: At his death Stanley owned real estate

Q84: At his death Tyrone's life insurance policy

Q87: At his death Stanley owned real estate

Q88: At his death Jose owned real estate

Q93: At her death Serena owned real estate

Q95: Madison was married at the time of

Q96: At her death Siena owned real estate

Q99: Harold and Mary are married and live

Q100: The executor of Isabella's estate incurred administration

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents