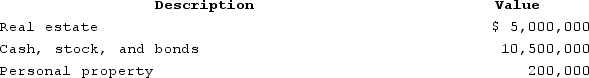

At his death in 2020, Nathan owned the following property:

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

The real estate is subject to a $1,700,000 mortgage and Nathan made taxable gifts in 2009 totaling $2 million, at which time he offset the gift tax with an applicable credit (exemption equivalent of $2 million). Nathan has never been married. What is the amount of his estate tax due? (Use Exhibit 14-1.)

Correct Answer:

Verified

Nathan...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: At her death Serena owned real estate

Q86: Christopher's residence was damaged by a storm

Q91: At her death Emily owned real estate

Q104: An applicable credit is subtracted in calculating

Q107: The generation-skipping tax is designed to accomplish

Q107: Which of the following is a true

Q110: Which of the following is a true

Q115: Which of the following is a true

Q128: Ava transferred $1.5 million of real estate

Q130: Gabriel had a taxable estate of $16

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents