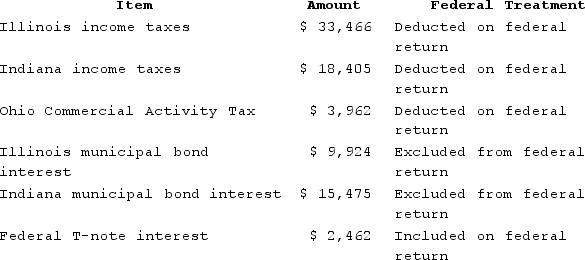

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $119,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $119,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $134,943

B) $149,447

C) $150,418

D) $165,479

Correct Answer:

Verified

Q63: Roxy operates a dress shop in Arlington,

Q68: Roxy operates a dress shop in Arlington,

Q78: Roxy operates a dress shop in Arlington,

Q78: Public Law 86-272 protects solicitation from income

Q81: Carolina's Hats has the following sales, payroll,

Q83: Lefty provides demolition services in several southern

Q84: Handsome Rob provides transportation services in several

Q85: Which of the following is an income-based

Q97: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q109: List the steps necessary to determine an

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents