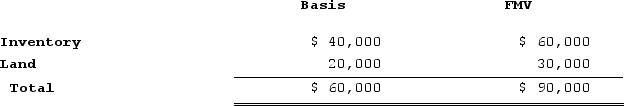

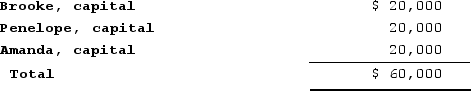

BPA Partnership is an equal partnership in which each of the partners has a basis in her partnership interest of $20,000. BPA reports the following balance sheet:

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

a. Identify the hot assets if Brooke decides to sell her interest in BPA.

b. Are these assets "hot" for purposes of distributions?

c. If BPA distributes the land to Brooke in complete liquidation of her partnership interest, what tax issues should be considered?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Locke is a 50percent partner in the

Q84: Daniel's basis in the DAT Partnership is

Q86: Tatia's basis in her TRQ Partnership interest

Q90: Nadine Fimple is a one-half partner in

Q92: Doris owns a one-third capital and profits

Q93: Heidi and Teresa are equal partners in

Q96: Heidi and Teresa are equal partners in

Q99: Lola is a 35percent partner in the

Q107: Tyson, a one-quarter partner in the TF

Q109: Esther and Elizabeth are equal partners in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents