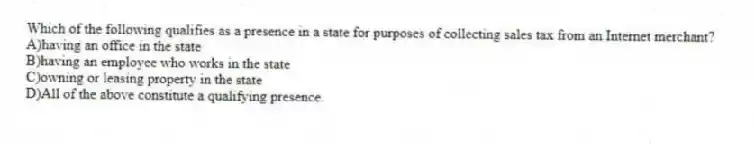

Which of the following qualifies as a presence in a state for purposes of collecting sales tax from an Internet merchant?

A) having an office in the state

B) having an employee who works in the state

C) owning or leasing property in the state

D) All of the above constitute a qualifying presence.

Correct Answer:

Verified

Q89: The Bipartisan Campaign Reform Act:

A)regulates soft money

Q90: The Bipartisan Campaign Reform Act is more

Q91: Which areas of commercial speech are fully

Q92: Son-of-Sam laws:

A)deal with political contributions by corporations.

B)provide

Q93: South Dakota is the location for many

Q95: Congress passed a law permitting those who

Q96: Which of the following pairs is incorrect?

A)Article

Q97: In which of the following areas of

Q98: Jamie has been accused of plagiarizing his

Q99: For state regulation of interstate commerce to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents