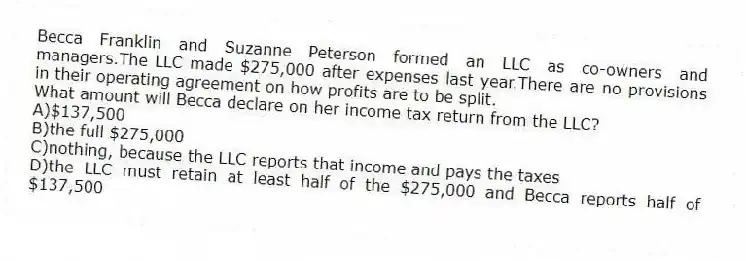

Becca Franklin and Suzanne Peterson formed an LLC as co-owners and managers.The LLC made $275,000 after expenses last year.There are no provisions in their operating agreement on how profits are to be split.

-What amount will Becca declare on her income tax return from the LLC?

A) $137,500

B) the full $275,000

C) nothing, because the LLC reports that income and pays the taxes

D) the LLC must retain at least half of the $275,000 and Becca reports half of $137,500

Correct Answer:

Verified

Q119: A Subchapter S or S Corporation is:

A)a

Q120: A shareholder proxy is:

A)good until revoked.

B)not subject

Q121: In which of the following forms of

Q122: Under Sarbanes-Oxley,which of the following is true?

A)Companies

Q123: The shareholders of Beazer Homes USA filed

Q125: Becca Franklin and Suzanne Peterson formed an

Q126: Becca Franklin and Suzanne Peterson formed an

Q127: Several retirement funds that own shares in

Q128: Which of the following forms of business

Q129: Grace Owen formed a corporation with three

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents