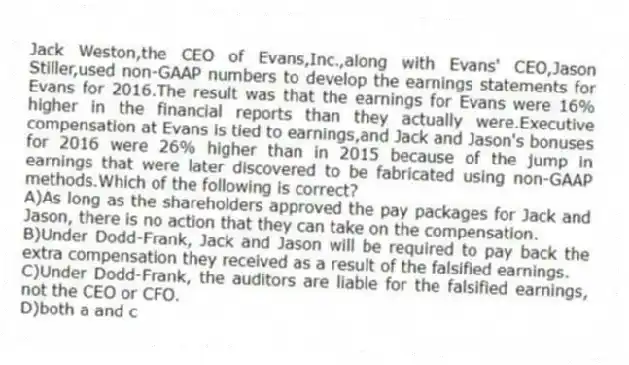

Jack Weston,the CEO of Evans,Inc.,along with Evans' CEO,Jason Stiller,used non-GAAP numbers to develop the earnings statements for Evans for 2016.The result was that the earnings for Evans were 16% higher in the financial reports than they actually were.Executive compensation at Evans is tied to earnings,and Jack and Jason's bonuses for 2016 were 26% higher than in 2015 because of the jump in earnings that were later discovered to be fabricated using non-GAAP methods.Which of the following is correct?

A) As long as the shareholders approved the pay packages for Jack and Jason, there is no action that they can take on the compensation.

B) Under Dodd-Frank, Jack and Jason will be required to pay back the extra compensation they received as a result of the falsified earnings.

C) Under Dodd-Frank, the auditors are liable for the falsified earnings, not the CEO or CFO.

D) both a and c

Correct Answer:

Verified

Q139: John Bloomberg and Erick Ashman have been

Q140: Jim Braun has been a partner in

Q141: List the provisions of Sarbanes-Oxley that affect

Q142: Alan Freeman is in the process of

Q143: ABC partnership owns and operates a potato

Q145: Which of the following is true about

Q146: Explain when a shareholder has a right

Q147: Which of the following is true about

Q148: Allied Van Lines has structured its company

Q149: Discuss CEO concerns regarding CEO compensation.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents