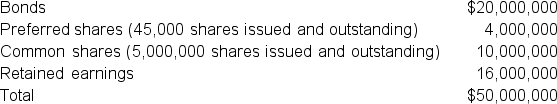

Regent Fireplaces Ltd.is establishing an appropriate discount rate to apply to this year's investment projects.The controller has suggested the weighted average cost of capital (WACC)would be an appropriate rate and has gathered the following information as a start to finding the WACC:

Selected information from the December 31, 2022 Balance Sheet

The bonds, which have 15 years to maturity, have a coupon rate of 6.0% with interest paid semi-annually.Current market yields on this risk security are currently about 4.5%.Flotation costs would be 1.0% of the issue price.

The preferred shares with a fixed dividend $4.10 per share currently trade at $82.00 per share.Flotation expenses of a new issue of preferred would be $3.20 per share.

The common shares are currently trading at $8.00 per share.The most recent dividend was $0.12 per share.Flotation expenses would be $0.25 per share.The risk-free rate is currently 1.75%, and the market rate of return is 7.25%.Regent Fireplaces Ltd.has a beta of 1.25.

Regent's tax rate is 30%.All flotation costs are stated as after-tax.

Calculate the weighted average cost of capital of Regent.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q56: The Saguenay Tourism Company has a beta

Q57: The Montreal Film Festival Company has a

Q58: Use the following statements to answer this

Q59: Toronto Skaters Company is an all-equity company

Q60: The Third Cup Company has a return

Q62: A firm is going to finance a

Q63: Multiplex Entertainment has 9 million common shares

Q64: Regent Fireplaces Ltd.is establishing an appropriate discount

Q65: Laurentide Resort has just paid a dividend

Q66: What is the cost of internally generated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents