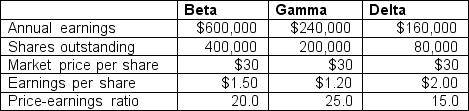

Beta Corporation is a manufacturing firm that is considering two acquisition targets.Gamma is a computer firm, while Delta is a manufacturing company.The relevant data are as follows:

The basis for the merger will be a share-for-share exchange based on market prices, and the share value of the combined firm is expected to remain unchanged.What would be the immediate effect of the two mergers on Beta Corp.'s earnings per share and price-earnings ratio? What other factors are important in Beta's analysis of its merger possibilities?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q77: A firm is evaluated using the liquidation

Q78: Define synergy and explain what effect it

Q79: The information for Montreal Design Inc.(MD)is provided

Q80: Goodwill is:

A)the difference between the purchase price

Q81: What would be the motivation behind protecting

Q83: You are a shareholder of a publicly

Q84: List and briefly describe three defense strategies

Q85: Sinatra Inc., a privately-owned company, has 2022

Q86: Third Cup is considering purchasing Canadian Tea

Q87: What is a tender offer?

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents