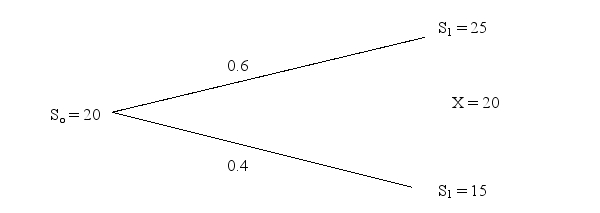

Francis has a long position on the underlying asset and has sold a number of call options with the following binomial tree:

Given the current asset price is $20 and r is 5%, what is the price of the this call option?

A) $2.86

B) $0.60

C) $21.43

D) −$21.43

Correct Answer:

Verified

Q37: _is the relationship between the price of

Q38: The basic put-call parity can be rearranged

Q39: Which of the following strategies does NOT

Q40: Given the following information and based

Q41: Higher _, higher _

A)price volatility; estimated volatility

B)implied

Q43: The current value of an underlying asset

Q44: The current stock price is $568.36, a

Q45: Create a table illustrating the range of

Q46: Toronto Skaters' stock is now worth $100.In

Q47: Toronto Skaters' stock is now worth $100.In

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents