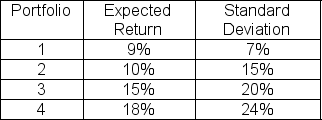

The expected return on the market is 11.5% with a standard deviation of 13% and the risk-free rate is 4%.Which of the following portfolios are undervalued?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Q55: Beta is a measure of:

A)Total risk.

B)Diversifiable risk.

C)Systematic

Q56: Which of the following describes how a

Q57: What is the standard deviation of

Q58: Use the following three statements to answer

Q59: Min has $5,000 to invest.The expected return

Q61: What is the beta of a portfolio

Q62: Which one of the following stocks would

Q63: Stock X has a standard deviation of

Q64: The current price of Stock Y is

Q65: Use the following two statements to answer

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents