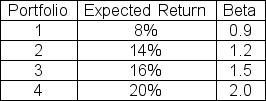

The expected return on the market is 12% with a standard deviation of 20% and the risk-free rate is 4%.Which of the following portfolios are correctly priced?

A) 1 and 2 only

B) 1 and 4 only

C) 2 and 3 only

D) 3 and 4 only

Correct Answer:

Verified

Q80: Use the following two statements to answer

Q81: Suppose you have $3,600 to invest in

Q82: The Fama-French model is best described by

Q83: What is the beta of a portfolio

Q84: Suppose the beta of a four-asset portfolio

Q86: What is the main criticism of the

Q87: The market expected return is 14% with

Q88: Security A is estimated to be linearly

Q89: Suppose you have $4,000 to invest in

Q90: Stock XYZ has a beta of 1.6

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents