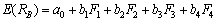

Suppose the returns on Security B are linearly related to four risk factors: F1, F2, F3, and F4.The required rate of return on Security B can be determined as follows:  .The risk-free rate is 5%.What is the risk premium for F4, if the required return of Security B is 20%, b1, b2, b3, and b4 are 0.5, 0.7, 0.6, and 0.9, respectively, and F1, F2, and F3 are 4.25%, 5.75%, and 6.5%, respectively?

.The risk-free rate is 5%.What is the risk premium for F4, if the required return of Security B is 20%, b1, b2, b3, and b4 are 0.5, 0.7, 0.6, and 0.9, respectively, and F1, F2, and F3 are 4.25%, 5.75%, and 6.5%, respectively?

A) 4.95%

B) 5.50%

C) 7.42%

D) 11.06%

Correct Answer:

Verified

Q102: Which one of the following is NOT

Q103: Briefly explain what the separation theorem is.

Q104: How do you explain a stock that

Q105: What is the role of the risk-free

Q106: What is the main difference between CAPM

Q108: Briefly describe what beta (

Q109: If two stocks had the same beta,

Q110: Given the following information: Q111: "There may be some truth in the Q112: Is it possible to invest more than

![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents