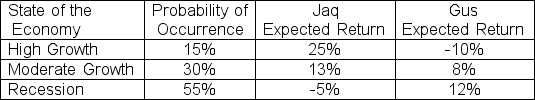

Cinderella plans to form a portfolio with two securities: Jaq and Gus.The correlation between the two securities is -1.Given the following forecasts, what are the weights in Jaq and Gus that will set the standard deviation of the portfolio equal to zero?

A) Portfolio weights in Jaq and Gus are 74.37% and 25.63%, respectively

B) Portfolio weights in Jaq and Gus are 25.63% and 74.37%, respectively

C) Portfolio weights in Jaq and Gus are 60.51% and 39.49%, respectively

D) Portfolio weights in Jaq and Gus are 39.49% and 60.51% respectively

Correct Answer:

Verified

Q61: What is the correlation between stocks Y

Q62: Suppose you own a two-security portfolio.You have

Q63: Suppose you own a portfolio that has

Q64: A portfolio consists of three securities: Treachery

Q65: Indiana Jones intends to form a portfolio

Q67: The expected returns for Bumpy Inc.and Bouncy

Q68: Given the following forecasts, what is the

Q69: Suppose you own a two-security portfolio.You have

Q70: Suppose you plan to create a portfolio

Q71: The expected returns for Hickory Inc.and Dickory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents