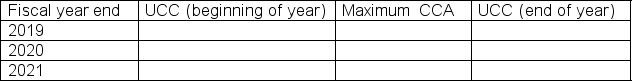

Montreal Smoked Meat Company (MSMC)purchased a machine on February 1, 2019 for $25,000.On October 10, 2019, it purchased another machine for $50,000.Both machines have a CCA rate of 20% and are in the same asset class.These are the only machines in the class and the company has made no asset purchases or sales for the following two years.MSMC's fiscal year end is December 31.Complete the following table (and show your work):

Correct Answer:

Verified

Q39: The sale of depreciable assets cannot result

Q40: Five years ago, Ottawa Styling Institute bought

Q41: Why is the tax deductibility of interest

Q42: Five years ago, J-Hi Corp.bought a paper

Q43: In the text the author says: "…corporate

Q44: Fred is confused.He has just deposited $100

Q45: Five years ago, Ottawa Styling Institute bought

Q46: Charles is considering investing in PDQ Technical

Q47: It is April and Michael is doing

Q49: Mira is considering two job offers: one

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents