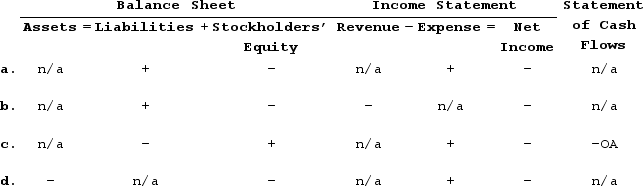

In December Year 1, Lucas Corporation sold merchandise for $10,000 cash. Lucas estimated that the warranty obligation relating to this sale is $700. On February 12, Year 2, Lucas paid cash of $550 to settle a related warranty claim by this customer.Which of the following reflects the effect of the year-end adjustment to record estimated warranty expense?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q7: Which of the following describes the effect

Q24: Which of the following items would most

Q52: During Year 1, its first year of

Q53: Taylor Tools has sales of $400,000 in

Q54: The adjusting entry required to recognize warranty

Q55: Extra Supplies had sales of $240,000 in

Q56: Homer Security Systems experienced an event that

Q59: According to GAAP a contingent liability can

Q60: GrayCo has initiated a lawsuit against FinCo

Q61: The following information is taken from the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents