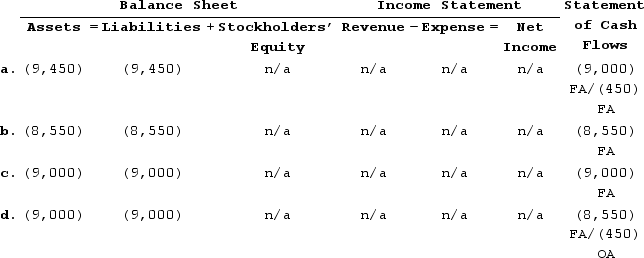

Baltimore Company issued a $9,000 face value discount note to Bank of the Chesapeake on March 1, Year 1. The note had a 5% discount rate and a one-year term to maturity. After accruing all interest expense due as of April 1, Year 2, Baltimore Company made the cash payment for the full amount due (i.e., principal and interest) to Bank of the Chesapeake. How does the cash payment affect Baltimore's financial statements?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q25: What is the current ratio used to

Q59: What type of account is Discount on

Q78: Mr. Ortega earns a monthly salary of

Q79: Which of the following would not likely

Q80: Mr. Ortega earns a monthly salary of

Q81: Seattle Company issued a $90,000 face value

Q82: On October 1, Year 1, Hartford Company

Q85: On October 1, Year 1 Coker Company

Q87: Seattle Company issued a $90,000 face value

Q88: During Year 1, Bradley Corporation issued a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents