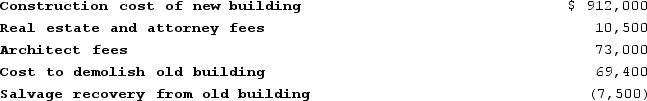

On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for $770,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below:  Which of the following are the capitalized costs of the land and the new building, respectively?

Which of the following are the capitalized costs of the land and the new building, respectively?

A) $842,400 and $985,000

B) $780,500 and $1,046,900

C) $849,900 and $977,500

D) $770,000 and $1,057,400

Correct Answer:

Verified

Q3: Which of the following terms is used

Q14: Which of the following would not be

Q16: Which of the following would be classified

Q30: On January 6, Year 1, Mount Jackson

Q31: Goodwill is the value attributable to favorable

Q33: Expenditures that extend the useful life of

Q38: Which of the following would not be

Q39: Harding Corporation acquired real estate that contained

Q103: The cost of natural resources includes the

Q109: When Company X purchases Company Y,Company X

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents