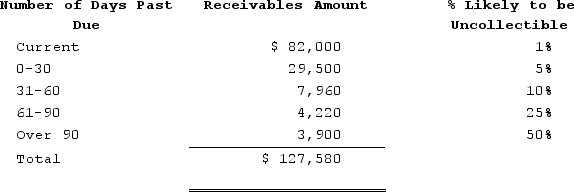

Domino Company ages its accounts receivable to estimate uncollectible accounts expense. Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $47,850 and $3,800, respectively. During Year 2, the company wrote off $2,820 in uncollectible accounts. In preparation for the company's estimate of uncollectible accounts expense for Year 2, Domino prepared the following aging schedule:  What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

What amount will be reported as uncollectible accounts expense on the Year 2 income statement?

A) $5,116

B) $6,096

C) $2,296

D) $2,820

Correct Answer:

Verified

Q2: Hoff Company uses the allowance method.An account

Q41: On January 1, Year 2, Kincaid Company's

Q42: Blain Company has $20,000 of accounts receivable

Q43: On January 1, Year 2, Kincaid Company's

Q44: The balance in Accounts Receivable at the

Q45: On January 1, Year 2, Kincaid Company's

Q47: On January 1, Year 2, Kincaid Company's

Q48: On January 1, Year 2, Kincaid Company's

Q50: Ron Company experienced an accounting event that

Q51: On January 1, Year 2, Kincaid Company's

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents