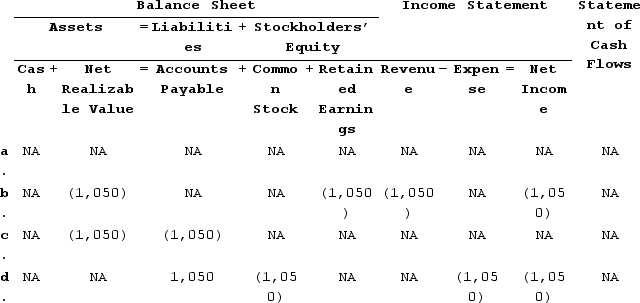

On December 31, Year 1, the Loudoun Corporation estimated that 3% of its credit sales of $112,500 would be uncollectible. Loudoun uses the allowance method. On February 15, Year 2, one of Loudoun's customers failed to pay his $1,050 account and the account was written off. On April 4, Year 2, this customer paid Loudoun the $1,050. Which of the following correctly states the effect of Loudoun's recording the reestablishment of the receivable on April 4, Year 2?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Q26: Which of the following is a cost

Q30: Rosewood Company made a loan of $16,000

Q33: When is it acceptable to use the

Q75: At the beginning of Year 3 Omega

Q77: At the beginning of Year 3 Omega

Q78: Hancock Medical Supply Company, earned $160,000 of

Q79: At the beginning of Year 3 Omega

Q81: The total amount of uncollectible accounts expense

Q83: Buttercup Florist uses the allowance method to

Q84: Which of the following correctly describes the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents