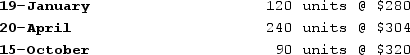

Max Company's first year in operation was Year 1. The following inventory purchase information comes from Max's accounting records for the year:

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

In December Year 1, Max sold 350 units for $480 each. Operating expenses for the year were $30,000, and the tax rate was 30%.

Required:a)Calculate the cost of goods sold using LIFO.b)Calculate the cost of goods sold using FIFO.c)What amount of income tax would Max have to pay if it uses LIFO?d)What amount of income tax would Max have to pay if it uses FIFO?e)Assuming that the results for Year 2 are representative of what Max can generally expect; would you recommend that the company use LIFO or FIFO? Explain.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Discuss the significance of the average number

Q141: Iona Corporation's ending inventory as of December

Q142: The following transactions apply to Sam's Skateboards.

Q143: On February 2, Year 2, a fire

Q144: Singh Company sold 75 units @ $350

Q145: The following information is for Choi Company

Q147: During December Year 2, Crowe Company sold

Q148: What ratio (usually an average from prior

Q150: Indicate whether each of the following statements

Q151: Curtis Company had the following transactions for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents