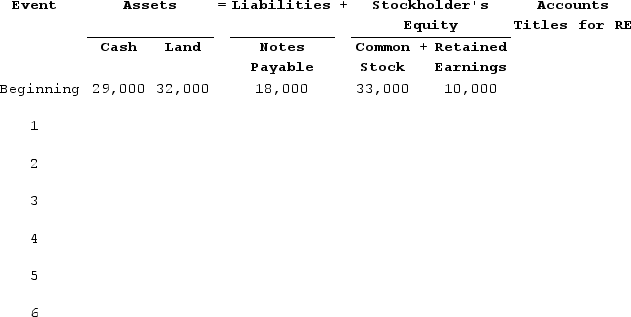

At the beginning of Year 2, the accounting records of Grace Company included the accounts and balances shown on the first row of the table below. During Year 2, the following transactions occurred:Received $95,000 cash for providing services to customersPaid salaries expense, $50,000Purchased land for $12,000 cashPaid $4,000 on note payablePaid operating expenses, $22,000Paid cash dividend, $2,500Required:a)Record the transactions in the appropriate accounts. Record the amounts of revenue, expense, and dividends in the retained earnings column. Enter 0 for items not affected. Provide appropriate titles for these accounts in the last column of the table. (The effects of the first event are shown below.)

b)What is the amount of total assets as of December 31, Year 2?c)What is the amount of total stockholders' equity as of December 31, Year 2?

b)What is the amount of total assets as of December 31, Year 2?c)What is the amount of total stockholders' equity as of December 31, Year 2?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q163: The following events are for Holiday Travel

Q164: Rosemont Company began operations on January 1,

Q165: The following transactions apply to Wilson Fitness

Q166: Classify each of the following events as

Q167: Young Company reported the following balance sheet

Q168: The following is a partial set of

Q169: Use the following information to prepare an

Q171: Grimes Corporation reports the following cash transactions

Q172: Indicate how each of the following transactions

Q173: The following is a partial set of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents