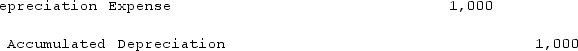

Vargas Company purchased a computer for $4,000 on January 1, Year 1. The computer is estimated to have a 4-year useful life and a $1,000 salvage value. What adjusting entry would Vargas record on December 31, Year 1 to recognize expense related to use of the computer?

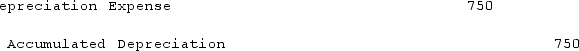

A)

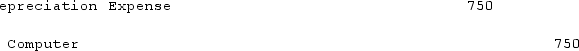

B)

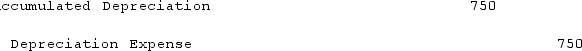

C)

D)

Correct Answer:

Verified

Q102: Which of the following statements about the

Q102: A transaction has been recorded in the

Q103: Manhattan Company recorded an adjusting entry to

Q104: Abbott Company purchased $6,500 of merchandise inventory

Q106: On August 1, Year 1, Bellisa Company

Q108: The following entry is taken from the

Q109: The Youngstown Company recorded the following adjustment

Q110: Peterson Corporation recorded an adjusting entry using

Q111: Vargas Company purchased a computer for $3,000

Q112: Abbott Company purchased $7,600 of merchandise inventory

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents