Consider each of the following accounting events:

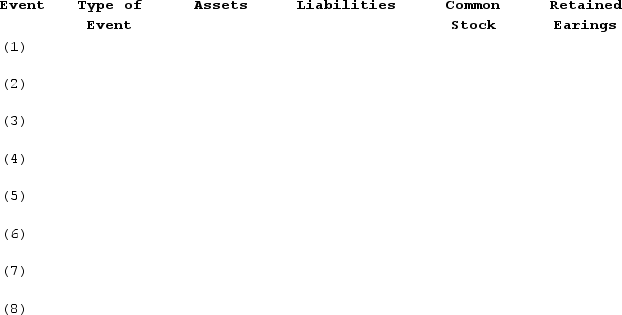

1)Debited cash and credited common stock.2)Debited accounts receivable and credited service revenue.3)Debited office supplies and credited accounts payable.4)Debited prepaid rent and credited cash.5)Debited cash and credited accounts receivable.6)Debited accounts payable and credited cash.7)Debited dividends and credited cash.8)Debited rent expense and credited prepaid rent.Required:For each of the events listed above, use the table shown below to:a)Identify the transaction giving rise to that event as asset source (AS), asset use (AU), asset exchange (AX), or claims exchange (CX)transaction.b)Show the effect of each transaction on the components of the accounting equation. Use "+" to signify an increase, "−" to signify a decrease, and "NA" to signify that a given element is not affected by the transaction. If one account increases and another account decreases within the same element, record "+/−" (i.e. an asset exchange transaction). Note that "Not Affected" means that the event does not affect that element of the financial statements.

Correct Answer:

Verified

Q97: Indicate whether each of the following statements

Q154: Assume that a company recorded the following

Q155: Indicate whether each of the following statements

Q156: Assume that a company recorded the following

Q157: Levitt Company prepared the following adjusted trial

Q158: Indicate whether each of the following statements

Q161: The following is a list of all

Q162: For each of the following journal entries,

Q163: The following is a list of adjusted

Q164: The following is a list of adjusted

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents