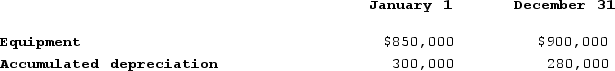

Preston Corporation uses the indirect method to prepare the cash flow from operating activities section of the statement of cash flows. The company had the following beginning and ending balances for Year 2:

During Year 2, Preston sold equipment for $60,000 that had originally been purchased for $140,000. The old equipment had accumulated depreciation of $120,000 at the time of sale. To replace the equipment, Preston purchased new equipment by making a $30,000 down payment and signing a two-year note for the balance due of $160,000.

During Year 2, Preston sold equipment for $60,000 that had originally been purchased for $140,000. The old equipment had accumulated depreciation of $120,000 at the time of sale. To replace the equipment, Preston purchased new equipment by making a $30,000 down payment and signing a two-year note for the balance due of $160,000.

Required:a)What was the cost of the new equipment purchased during the year?b)What is the gain or loss on the sale of the old equipment?c)How will the gain or loss be reported on the statement of cash flows?d)How will the sale of the equipment be reported in the cash flow from investing activities section of the statement of cash flows?e)How will the purchase of equipment be reported in the cash flow from investing activities section of the statement of cash flows?f)How will the issuance of the two-year note be reported on the statement of cash flows?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q4: What is the major advantage of using

Q140: Howard Company uses the direct method to

Q141: Weymouth Company uses the indirect method to

Q142: Burgess Company uses the direct method to

Q143: Garrity, Incorporated uses the perpetual inventory method.

Q145: Indicate whether each of the following statements

Q146: Consider each of the following activities.

Required:Identify whether

Q147: Manhattan Corporation provided the following partial list

Q148: The following data is supplied from the

Q149: Indicate whether each of the following statements

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents