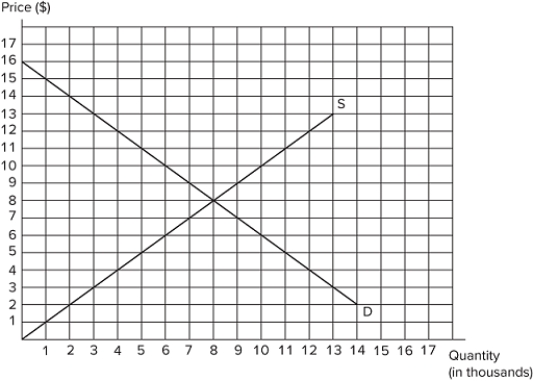

Suppose the government has imposed a $6 per unit tax in the market shown in the graph.  If the government raises the tax to $10 per unit:tax revenue will increase by $30,000.deadweight loss will increase by $16,000the quantity purchased will decrease by 2,000 units.

If the government raises the tax to $10 per unit:tax revenue will increase by $30,000.deadweight loss will increase by $16,000the quantity purchased will decrease by 2,000 units.

A) I only

B) II and III only

C) I and III only

D) I, II, and III

Correct Answer:

Verified

Q69: When considering different tax levels, the revenue-maximizing

Q70: The Laffer curve demonstrates that raising tax

Q71: In general, raising taxes has:

A)increasing returns to

Q72: When considering the interplay of the price

Q73: A $0.50 tax on lemons currently generates

Q75: The _ effect tells us that when

Q76: The market for cigarettes likely has a

Q77: Imposing a tax in a market with

Q78: Taxing the market for alcohol at the

Q79: Suppose the government is considering imposing a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents