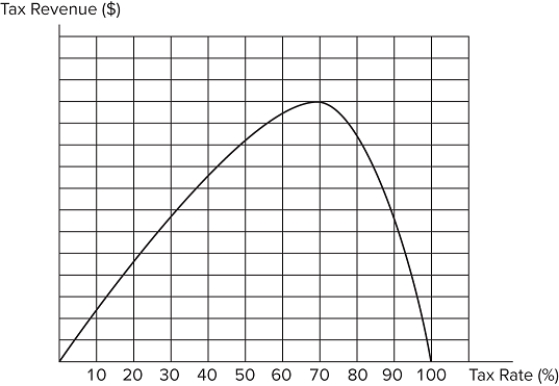

Consider the Laffer curve for a hypothetical good as displayed in the graph shown.  Suppose the current tax rate is 45 percent. This implies that: the price effect currently outweighs the quantity effect.the government could increase revenue by lowering the tax rate.the current tax rate is efficient.

Suppose the current tax rate is 45 percent. This implies that: the price effect currently outweighs the quantity effect.the government could increase revenue by lowering the tax rate.the current tax rate is efficient.

A) I only

B) II only

C) II and III only

D) I and II only

Correct Answer:

Verified

Q58: In the real world, lump-sum taxes are:

A)often

Q59: The federal income tax _ than a

Q60: The federal income tax _ than a

Q61: If the _ effect is greater than

Q62: At lower tax rates the _ effect

Q64: When raising taxes, the quantity effect tells

Q65: Suppose the government is considering imposing a

Q66: If the price effect outweighs the quantity

Q67: Raising taxes:

A)always raises tax revenues.

B)always decreases tax

Q68: When raising taxes, the price effect tells

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents