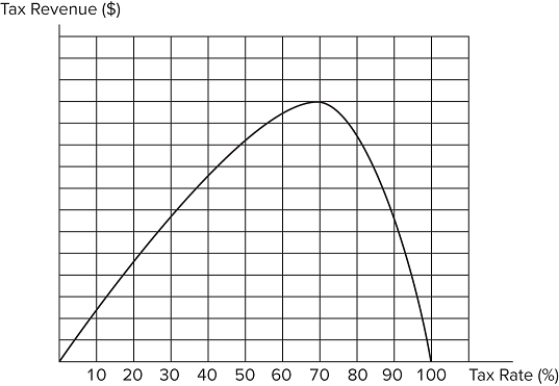

Consider the Laffer curve for a hypothetical good as displayed in the graph shown.  If the current tax rate is 90 percent: the quantity effect currently outweighs the price effect.the government could increase revenue by lowering the tax rate.deadweight loss will increase if the tax rate is lowered.

If the current tax rate is 90 percent: the quantity effect currently outweighs the price effect.the government could increase revenue by lowering the tax rate.deadweight loss will increase if the tax rate is lowered.

A) I and III only

B) II only

C) I, II, and III

D) I and II only

Correct Answer:

Verified

Q78: Taxing the market for alcohol at the

Q79: Suppose the government is considering imposing a

Q80: The _ tells us that when the

Q81: The concept of incidence is used to

Q82: Research shows that people rearrange their income

Q84: The tax rate that maximizes government revenue

Q85: When tax rates fall, people tend to:

A)greatly

Q86: Policymakers have the ability to affect:

A)the economic

Q87: When policy makers are deciding where to

Q88: Most research suggests that the elasticity of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents