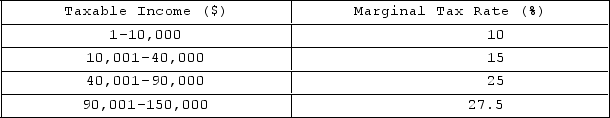

The table shown displays the marginal tax rates that correspond to each taxable income bracket for an individual.

Consider two individuals: Griffin and Dalia. Griffin has $90,000 of taxable income and Dalia has $95,000 of taxable income. Which of the following statements is true?

A) Dalia owes $3,625 more in taxes than Griffin.

B) Griffin owes $1,250 more in taxes than Dalia.

C) Dalia owes $1,250 more in taxes than Griffin.

D) None of these are correct.

Correct Answer:

Verified

Q134: A tax on individuals' earnings is called

Q135: The table shown displays the marginal tax

Q136: The table shown displays the marginal tax

Q137: A tax on the income earned by

Q138: A tax on the wages paid to

Q140: An income tax is charged on:

A)the earnings

Q141: A helpful way to put government revenues

Q142: Which taxes are used to pay for

Q143: High-income countries tend to collect _ as

Q144: Discretionary spending involves public expenditures that:

A)have to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents