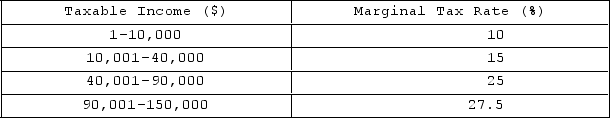

The table shown displays the marginal tax rates that correspond to each taxable income bracket for an individual.

What amount in taxes would a person with $75,000 of taxable income owe?

A) $18,750

B) $14,250

C) $25,750

D) $10,750

Correct Answer:

Verified

Q116: Which of the following is not one

Q117: Suppose Javier earns $50,000 per year and

Q118: In general, the most efficient taxes:

A)are often

Q119: Taxes are generally classified into three categories:

A)progressive,

Q120: The majority of total tax revenues come

Q122: The table shown displays the marginal tax

Q123: The table shown displays the marginal tax

Q124: The table shown displays the marginal tax

Q125: What is the largest source of income

Q126: A payroll tax is charged on:

A)the earnings

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents