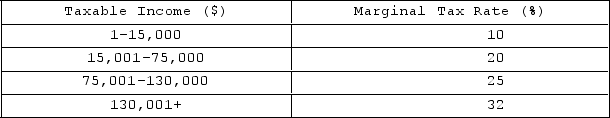

The table shown displays the marginal tax rates that correspond to each taxable income bracket for an individual.

Consider two individuals: Nia and Sasha. Nia has $75,000 of taxable income and Sasha has $76,000 of taxable income. Which of the following statements is true?Sasha owes $4,000 more in taxes than Nia.Sasha owes $19,000 in taxes.Nia owes $13,500 in taxes.

A) I and II only

B) III only

C) II only

D) II and III only

Correct Answer:

Verified

Q126: A payroll tax is charged on:

A)the earnings

Q127: A capital gains tax is charged on:

A)the

Q128: The table shown displays the marginal tax

Q129: A sales tax is charged on:

A)the earnings

Q130: The individual income tax in the United

Q132: The table shown displays the marginal tax

Q133: The marginal tax rate is charged on:

A)the

Q134: A tax on individuals' earnings is called

Q135: The table shown displays the marginal tax

Q136: The table shown displays the marginal tax

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents