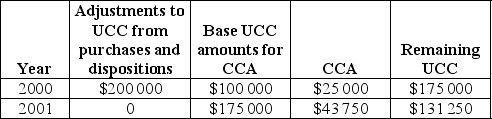

A company purchased a piece of equipment in 2000. The UCC amounts for this equipment are as follows:  How much tax savings could the company accumulate due to the CCA by the end of 2001 if the corporate tax rate is 50%?

How much tax savings could the company accumulate due to the CCA by the end of 2001 if the corporate tax rate is 50%?

A) $12 465

B) $24 580

C) $30 925

D) $34 375

E) $68 750

Correct Answer:

Verified

Q4: The before-tax MARR is

A)higher than the after-tax

Q5: The undepreciated capital cost (UCC)is equal to

A)the

Q6: Why should businesses take into account tax

Q7: GEMTECH Ltd. is an engineering construction company.

Q8: Why do businesses want to depreciate their

Q10: The capital tax factor (CTF)is a value

Q11: SHMON Inc. wants to invest in future

Q12: Sample CCA Rates and Classes are presented

Q13: SINCO Ltd. purchased a piece of equipment

Q14: The salvage value of a ten-year-old truck

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents