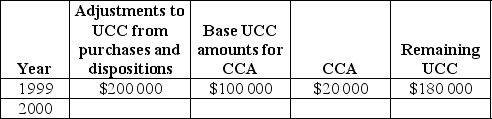

An engineering construction company purchased an excavator for $200 000 in 1999 and a bulldozer for $180 000 in 2000. The UCC for the changes in asset holdings due to the purchases of an excavator are as follows:  How much tax savings could the company accumulate due to the CCA by the end of 2000 if the corporate tax rate is 50%?

How much tax savings could the company accumulate due to the CCA by the end of 2000 if the corporate tax rate is 50%?

A) $20 000

B) $27 000

C) $32 000

D) $37 000

E) $54 000

Correct Answer:

Verified

Q14: The salvage value of a ten-year-old truck

Q15: The effect of taxation on annual savings

Q16: A firm has just purchased a vehicle

Q17: Sirius Ltd. purchased a piece of equipment

Q18: In the CCA system "the half-year rule"

Q20: What was the goal of the Canadian

Q21: A manufacturing company bought a truck for

Q22: DON Corporation is making a decision about

Q23: An engineering project involves the purchase of

Q24: Suppose that a Canadian company bought a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents