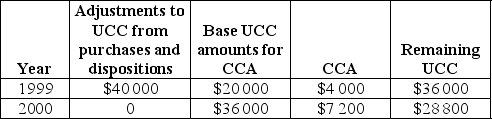

Sirius Ltd. purchased a piece of equipment at the very beginning of the 1999 fiscal year. The UCC amounts for this equipment are as follows:  What was the present worth at the beginning of fiscal 1999 of the company's savings due to CCA over the two-year period if the corporate tax rate was 25% and the interest rate was 10%?

What was the present worth at the beginning of fiscal 1999 of the company's savings due to CCA over the two-year period if the corporate tax rate was 25% and the interest rate was 10%?

A) $2 397

B) $2 488

C) $2 800

D) $3 214

E) $4 263

Correct Answer:

Verified

Q12: Sample CCA Rates and Classes are presented

Q13: SINCO Ltd. purchased a piece of equipment

Q14: The salvage value of a ten-year-old truck

Q15: The effect of taxation on annual savings

Q16: A firm has just purchased a vehicle

Q18: In the CCA system "the half-year rule"

Q19: An engineering construction company purchased an excavator

Q20: What was the goal of the Canadian

Q21: A manufacturing company bought a truck for

Q22: DON Corporation is making a decision about

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents