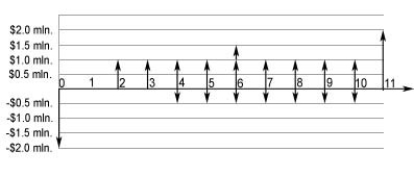

J.D.Irving Ltd. is considering a construction project with $2 million initial investment that will last for 10 years. The duration of the construction phase is one year. Once the construction is over, the project starts yielding a constant annual revenue of $1.0 million. By the end of the fifth year the project generates $0.5 million extra revenue. The annual operation and maintenance expenses of $0.5 million will start at year four and last till the end of the project's life. At the very end of the 10-year project the used equipment can be sold for $1.5 million. What cash flow diagram represents this project?

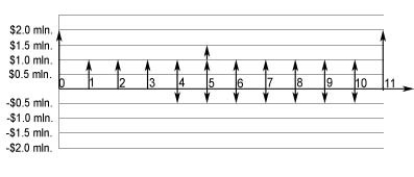

A)

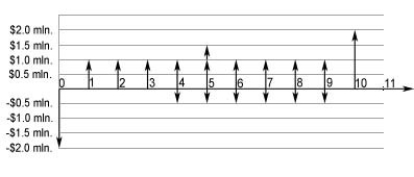

B)

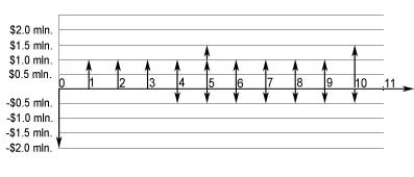

C)

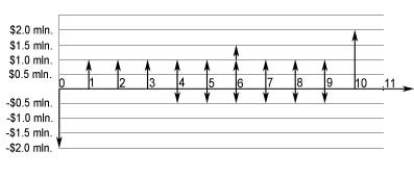

D)

E)

Correct Answer:

Verified

Q4: Your credit card statement says that your

Q5: If an interest rate is 18% per

Q6: How many compounding periods are needed to

Q7: The nominal interest rate is 6% per

Q8: The principal amount is

A)the present value of

Q10: Emily is considering two mutually exclusive financial

Q11: You would like to have $8 500

Q12: Nominal interest rate is calculated by

A)summing up

Q13: You invest $10 000 at 5% interest

Q14: Bill wants to buy a new car

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents