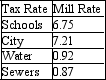

A homeowner's tax statement lists the following mill rates for various municipal services:  The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

The homeowner paid $3937.50 in property taxes last year. What is the assessed value of his property?

A) $264,617

B) $265,509

C) $461,066

D) $250,000

E) $437,500

Correct Answer:

Verified

Q80: Nitin is paid on a graduated commission

Q81: A client has a first mortgage of

Q82: M Studios (Quebec) had retail sales of

Q83: Calculate the price including both GST and

Q84: At the start of the year, Ajax

Q86: Calculate the PST on a jacket costing

Q87: A class of 25 students wrote a

Q88: A homeowner's tax statement lists the following

Q89: A piece of property valued at $2,000,000

Q90: Calculate next year's mill rate.

A) 8.3497

B) 8.3923

C)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents