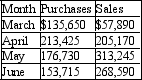

Sawchuk's Home and Garden Centre files monthly HST returns. The purchases on which it paid the HST and the sales on which it collected the HST for the last four months were as follows:

Based on an HST rate of 13%, calculate the HST remittance or refund due for each month.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q211: Evaluate the answer correct to the

Q359: Sonja is paid $42.50 per hour as

Q360: A seasonal manufacturing operation began the calendar

Q361: Evaluate the following: 30 /3 + 12

Q362: Evaluate the following: 30 / (3 +

Q363: Johnston Distributing, Inc. files quarterly GST returns.

Q365: One year ago Helga allocated the funds

Q366: The assessment on a farm consists of

Q367: Evaluate the following: 96 - (6 -

Q369: a) To the nearest whole percent, what

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents