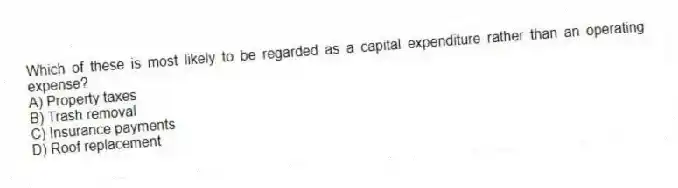

Which of these is most likely to be regarded as a capital expenditure rather than an operating expense?

A) Property taxes

B) Trash removal

C) Insurance payments

D) Roof replacement

Correct Answer:

Verified

Q8: Given the following information, calculate the overall

Q9: The expected costs to make replacements, alterations,

Q10: For smaller income-producing properties, appraisers may use

Q11: Most appraisers adhere to an "above-line" treatment

Q12: In calculating net operating income, vacancy losses

Q14: One complication that appraisers may face is

Q15: Gross income multiplier analysis assumes that the

Q16: The process of converting periodic income into

Q17: Given the following information, calculate the net

Q18: When using discounted cash flow analysis for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents