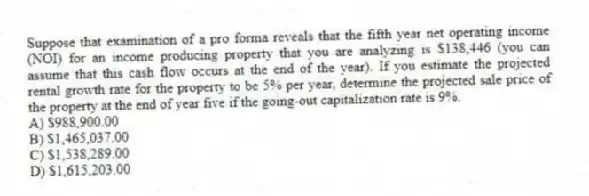

Suppose that examination of a pro forma reveals that the fifth year net operating income (NOI) for an income producing property that you are analyzing is $138,446 (you can assume that this cash flow occurs at the end of the year) . If you estimate the projected rental growth rate for the property to be 5% per year, determine the projected sale price of the property at the end of year five if the going-out capitalization rate is 9%.

A) $988,900.00

B) $1,465,037.00

C) $1,538,289.00

D) $1,615,203.00

Correct Answer:

Verified

Q17: Given the following information, calculate the net

Q18: When using discounted cash flow analysis for

Q19: When calculating the net operating income of

Q20: Net operating income is similar to which

Q21: Suppose that you are attempting to value

Q23: Suppose that an income producing property is

Q24: Suppose that an income producing property is

Q25: Using the following information, determine the

Q26: Three highly similar and competitive income-producing

Q27: Given the following information, calculate the effective

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents