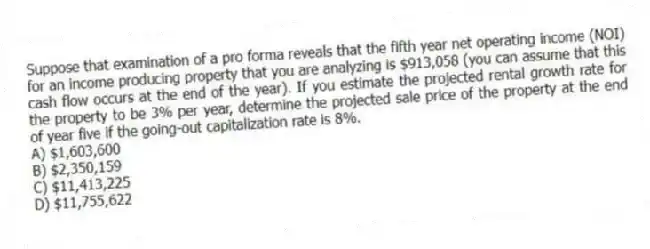

Suppose that examination of a pro forma reveals that the fifth year net operating income (NOI) for an income producing property that you are analyzing is $913,058 (you can assume that this cash flow occurs at the end of the year) . If you estimate the projected rental growth rate for the property to be 3% per year, determine the projected sale price of the property at the end of year five if the going-out capitalization rate is 8%.

A) $1,603,600

B) $2,350,159

C) $11,413,225

D) $11,755,622

Correct Answer:

Verified

Q26: Three highly similar and competitive income-producing

Q27: Given the following information, calculate the effective

Q28: Given the following information, calculate the appropriate

Q29: Given the following information, calculate the appropriate

Q30: Using the following information, determine the

Q31: Four highly similar and competitive income-producing

Q32: Suppose that you are attempting to value

Q34: Given the following information, calculate the effective

Q35: Analysis of a subject property's pro forma

Q36: Given the following information, calculate the effective

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents