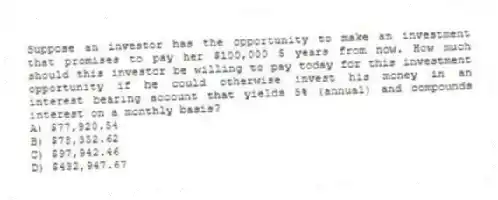

Suppose an investor has the opportunity to make an investment that promises to pay her $100,000 5 years from now. How much should this investor be willing to pay today for this investment opportunity if he could otherwise invest his money in an interest bearing account that yields 5% (annual) and compounds interest on a monthly basis?

A) $77,920.54

B) $78,352.62

C) $97,942.46

D) $432,947.67

Correct Answer:

Verified

Q26: Suppose you are starting a Ph.D. program

Q27: An investor originally paid $22,000 for a

Q28: Suppose that a property can generate cash

Q29: Suppose you own a house that you

Q30: Suppose that an industrial building can be

Q31: Suppose an investor is interested in purchasing

Q32: Suppose an investor deposits $5,000 in an

Q33: Suppose an investor is interested in purchasing

Q34: Suppose you have found a tenant who

Q36: Suppose your personal financial goal is to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents