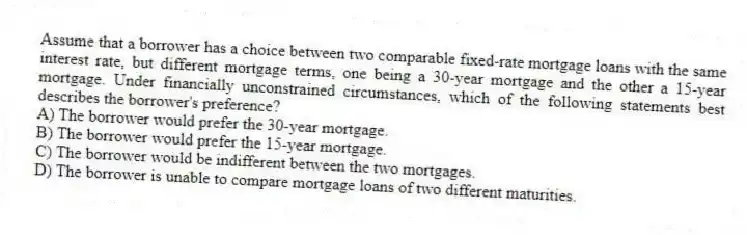

Assume that a borrower has a choice between two comparable fixed-rate mortgage loans with the same interest rate, but different mortgage terms, one being a 30-year mortgage and the other a 15-year mortgage. Under financially unconstrained circumstances, which of the following statements best describes the borrower's preference?

A) The borrower would prefer the 30-year mortgage.

B) The borrower would prefer the 15-year mortgage.

C) The borrower would be indifferent between the two mortgages.

D) The borrower is unable to compare mortgage loans of two different maturities.

Correct Answer:

Verified

Q3: While a variety of loan terms are

Q4: When lenders charge discount points (prepaid interest)

Q5: To encourage borrowers to accept adjustable rate

Q6: Given the following information on a fixed-rate

Q7: From the borrower's perspective, the effective borrowing

Q9: For the purposes of estimating the effective

Q10: Given the following information on a 30-year

Q11: The monthly mortgage payment divided by the

Q12: When fully amortizing loans call for equal

Q13: With the recent popularity of adjustable-rate mortgages

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents