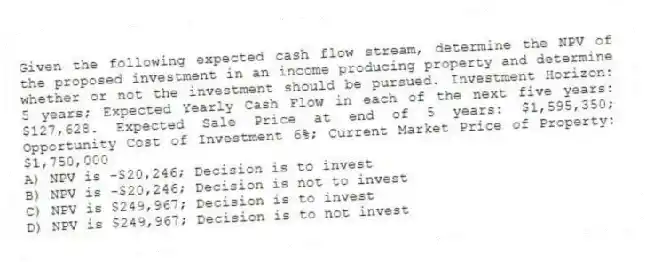

Given the following expected cash flow stream, determine the NPV of the proposed investment in an income producing property and determine whether or not the investment should be pursued. Investment Horizon: 5 years; Expected Yearly Cash Flow in each of the next five years: $127,628. Expected Sale Price at end of 5 years: $1,595,350; Opportunity Cost of Investment 6%; Current Market Price of Property: $1,750,000

A) NPV is -$20,246; Decision is to invest

B) NPV is -$20,246; Decision is not to invest

C) NPV is $249,967; Decision is to invest

D) NPV is $249,967; Decision is to not invest

Correct Answer:

Verified

Q22: Given the following information regarding an income

Q23: Suppose an industrial building can be purchased

Q24: Determine the net present value (NPV) of

Q25: Given the following information regarding an income

Q26: Given the following expected cash flow stream,

Q27: Suppose you purchased an income producing property

Q28: Given the following information regarding an income

Q30: Given the following expected cash flow stream,

Q31: Given the following information regarding an income

Q32: Given the following information regarding an income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents