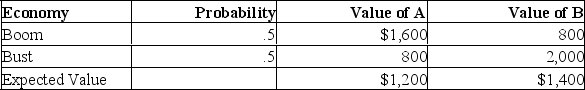

Firm A does well in a boom economy. Firm B does well in a bust economy. The probability of a boom is 50%. The end of period values of the two firms depend on the economy as shown below:

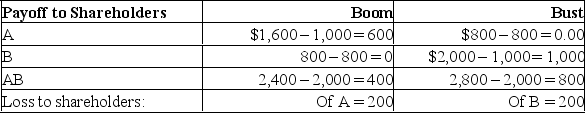

Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Determine the gain or loss under each state of economy for the stockholders of A and B separately and for the combined firm AB. Should either the stockholders or bondholders be willing to support the merger (prove and state why)?

Both firms have debt outstanding with a face value of $1,000. In order to diversify, the two firms have proposed a merger. The NPV of the merger is zero. Determine the gain or loss under each state of economy for the stockholders of A and B separately and for the combined firm AB. Should either the stockholders or bondholders be willing to support the merger (prove and state why)?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: A merger should not take place simply

Q42: Dexter Department Stores has a market value

Q44: Which of the following defensive tactics completely

Q45: Shuster merges with Leverne. Shuster agrees to

Q46: Chucky Chester Inc. takes over Billy Bob

Q47: Dexter Department Stores has a market value

Q48: Dexter Department Stores has a market value

Q49: Firm A is acquiring Firm B for

Q77: Principal,Inc. is acquiring Secondary Companies for $29,000

Q85: Describe the three basic legal procedures that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents